Compound Semiconductor Photonics Industry Report 2025: Market Dynamics, Growth Projections, and Strategic Insights for the Next 5 Years

- Executive Summary & Market Overview

- Key Technology Trends in Compound Semiconductor Photonics

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Opportunities

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

Compound semiconductor photonics refers to the use of compound semiconductor materials—such as gallium arsenide (GaAs), indium phosphide (InP), and gallium nitride (GaN)—in the design and manufacture of photonic devices. These materials offer superior electronic and optical properties compared to traditional silicon, enabling high-performance applications in telecommunications, data centers, consumer electronics, automotive LiDAR, and advanced sensing. As of 2025, the compound semiconductor photonics market is experiencing robust growth, driven by the surging demand for high-speed data transmission, 5G infrastructure, and next-generation optical communication systems.

According to MarketsandMarkets, the global compound semiconductor market is projected to reach USD 53.3 billion by 2025, with photonics representing a significant and rapidly expanding segment. The proliferation of cloud computing, artificial intelligence, and the Internet of Things (IoT) is fueling the need for faster and more efficient photonic components, such as lasers, photodetectors, and modulators, which are predominantly fabricated using compound semiconductors.

Key industry players—including Coherent Corp., Lumentum Holdings Inc., and ams OSRAM—are investing heavily in research and development to enhance device performance and reduce manufacturing costs. The integration of compound semiconductor photonics into silicon photonics platforms is also gaining momentum, aiming to combine the scalability of silicon with the superior optoelectronic properties of compound materials.

Regionally, Asia-Pacific dominates the market, led by strong manufacturing bases in China, Japan, and South Korea, and supported by government initiatives to advance photonics and semiconductor technologies. North America and Europe are also significant contributors, driven by innovation in telecommunications and automotive sectors.

- Telecommunications: The rollout of 5G and fiber-optic networks is accelerating demand for high-speed optical transceivers and amplifiers.

- Data Centers: Hyperscale data centers require advanced photonic interconnects for efficient data transfer and energy savings.

- Automotive: LiDAR and advanced driver-assistance systems (ADAS) increasingly rely on compound semiconductor-based photonic devices.

In summary, the compound semiconductor photonics market in 2025 is characterized by rapid technological advancements, expanding application areas, and strong investment from both industry and government stakeholders. The sector is poised for continued growth as digital transformation and connectivity trends intensify worldwide.

Key Technology Trends in Compound Semiconductor Photonics

Compound semiconductor photonics is experiencing rapid technological evolution, driven by the demand for high-speed data transmission, energy-efficient optoelectronic devices, and advanced sensing applications. In 2025, several key technology trends are shaping the landscape of this sector:

- Integration of Photonics and Electronics: The convergence of photonic and electronic components on a single chip is accelerating, particularly through heterogeneous integration. This approach leverages the superior optical properties of compound semiconductors (such as GaAs, InP, and GaN) with the mature processing of silicon, enabling compact, high-performance photonic integrated circuits (PICs). This trend is crucial for next-generation data centers and high-speed optical interconnects, as highlighted by Intel Corporation and imec.

- Advancements in VCSELs and Laser Diodes: Vertical-cavity surface-emitting lasers (VCSELs) and distributed feedback (DFB) laser diodes based on compound semiconductors are seeing significant improvements in efficiency, wavelength stability, and scalability. These advancements are vital for 3D sensing in consumer electronics, automotive LiDAR, and high-speed optical communications, as reported by ams OSRAM and Lumentum Holdings.

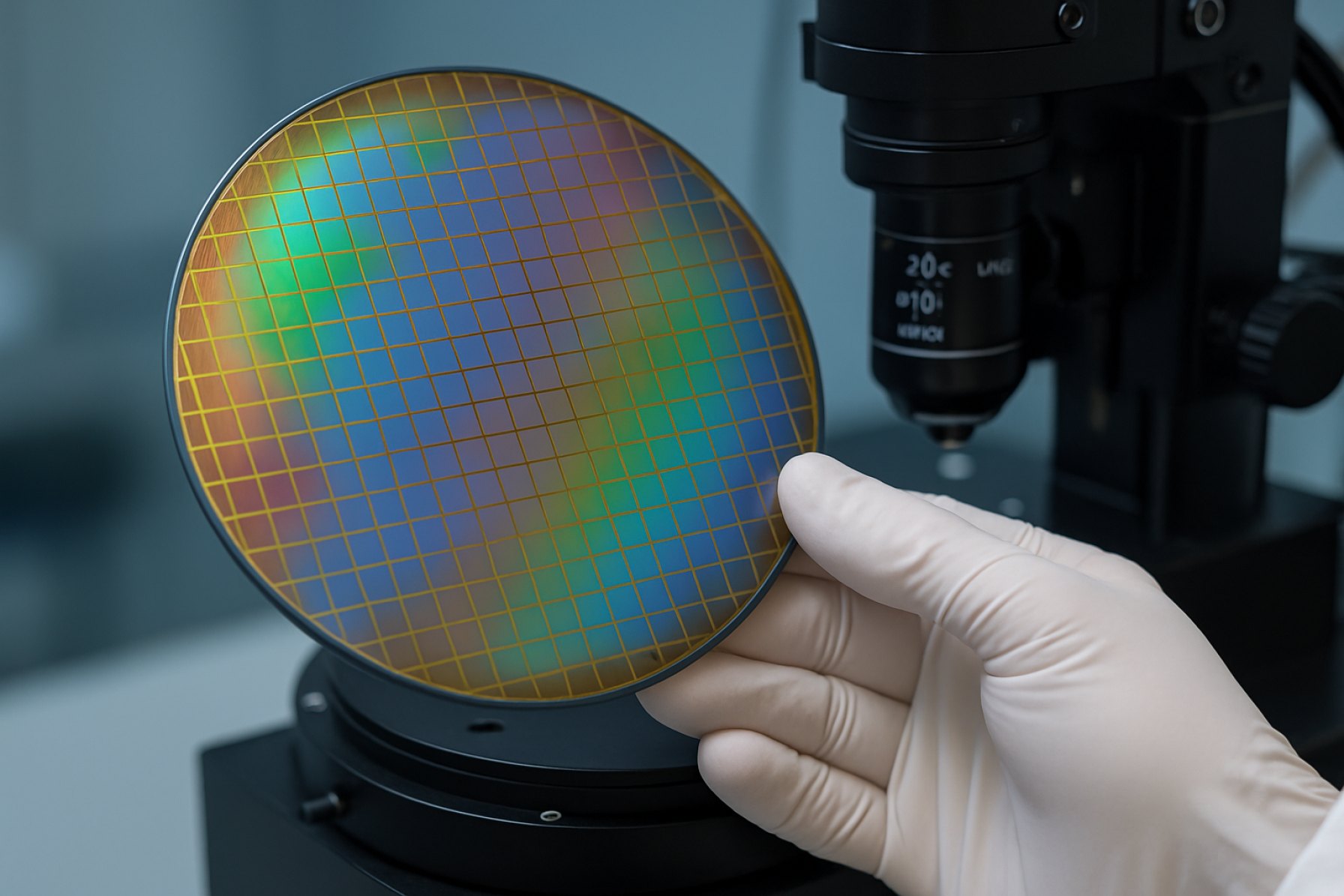

- Miniaturization and Wafer-Scale Manufacturing: The push toward miniaturized photonic devices is driving innovations in wafer-scale manufacturing techniques, such as epitaxial growth and advanced lithography. These methods enable mass production of high-quality compound semiconductor photonic devices, reducing costs and improving device uniformity, as detailed by III-V Lab and SEMI.

- Quantum Photonics: Compound semiconductors are at the forefront of quantum photonics, enabling the development of single-photon sources, quantum dots, and entangled photon pairs. These technologies are foundational for quantum communication and computing, with active research and commercialization efforts from organizations like Oxford Instruments and European Quantum Flagship.

- Expansion into New Wavelengths: There is growing interest in compound semiconductor photonic devices operating in the mid-infrared and ultraviolet spectra. These devices are unlocking new applications in environmental monitoring, medical diagnostics, and industrial sensing, as noted by Hamamatsu Photonics and TrendForce.

These trends underscore the dynamic innovation ecosystem in compound semiconductor photonics, positioning the sector for robust growth and diversification in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape of the compound semiconductor photonics market in 2025 is characterized by a dynamic mix of established industry leaders, innovative startups, and strategic collaborations. The sector is driven by rapid advancements in optoelectronic devices, including lasers, photodetectors, and modulators, which are essential for applications in telecommunications, data centers, automotive LiDAR, and consumer electronics.

Key players dominating the market include ams OSRAM, Lumentum Holdings Inc., Coherent Corp. (formerly II-VI Incorporated), and TRIOPTICS. These companies leverage their extensive R&D capabilities and global manufacturing footprints to maintain technological leadership, particularly in gallium arsenide (GaAs) and indium phosphide (InP) based photonic devices.

In 2025, ams OSRAM continues to expand its portfolio of high-performance photonic components, focusing on miniaturization and integration for automotive and mobile applications. Lumentum Holdings Inc. remains a key supplier of optical transceivers and 3D sensing solutions, benefiting from the ongoing deployment of 5G networks and the proliferation of advanced driver-assistance systems (ADAS). Coherent Corp. has strengthened its position through strategic acquisitions and investments in compound semiconductor wafer production, targeting both telecom and industrial laser markets.

Emerging players and startups are also making significant inroads, particularly in niche segments such as quantum photonics and integrated photonic circuits. Companies like Ensemi and Rockley Photonics are gaining traction by developing innovative solutions for health monitoring and next-generation data communications.

Strategic partnerships and mergers are shaping the competitive dynamics, as companies seek to accelerate innovation and scale production. For example, the collaboration between ams OSRAM and Lumentum Holdings Inc. on advanced VCSEL (vertical-cavity surface-emitting laser) technology exemplifies the trend toward joint development to address complex market demands.

Overall, the 2025 compound semiconductor photonics market is marked by intense competition, rapid technological evolution, and a strong focus on vertical integration and ecosystem partnerships, as leading players position themselves to capture growth in high-value photonics applications.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The compound semiconductor photonics market is poised for robust growth between 2025 and 2030, driven by escalating demand in telecommunications, data centers, automotive LiDAR, and consumer electronics. According to projections by MarketsandMarkets, the global compound semiconductor market—including photonics—will experience a compound annual growth rate (CAGR) of approximately 7–9% during this period. The photonics segment, in particular, is expected to outpace the broader market due to rapid advancements in optoelectronic devices such as lasers, photodetectors, and high-speed optical transceivers.

Revenue forecasts indicate that the compound semiconductor photonics market could surpass $25 billion by 2030, up from an estimated $14 billion in 2025. This growth is underpinned by the proliferation of 5G infrastructure, the expansion of fiber-optic networks, and the increasing integration of photonic components in electric vehicles and advanced driver-assistance systems (ADAS). Yole Group highlights that the photonics sub-segment will be a primary revenue driver, with vertical-cavity surface-emitting lasers (VCSELs), photonic integrated circuits (PICs), and high-efficiency LEDs leading the charge.

In terms of volume, the market is expected to witness a significant uptick in unit shipments, particularly for GaAs- and InP-based photonic devices. The adoption of compound semiconductor photonics in consumer electronics—such as facial recognition modules and augmented reality (AR) devices—will contribute to high-volume growth. Omdia projects that annual shipments of compound semiconductor photonic components could exceed 10 billion units by 2030, reflecting their ubiquity in next-generation devices.

- CAGR (2025–2030): Estimated at 7–9% for the photonics segment.

- Revenue (2025): ~$14 billion; Revenue (2030): >$25 billion.

- Volume (2030): >10 billion units annually.

Key growth regions include Asia-Pacific, led by China, South Korea, and Taiwan, where aggressive investments in 5G and smart manufacturing are accelerating adoption. North America and Europe are also expected to see strong growth, particularly in automotive and data center applications. Overall, the 2025–2030 period will be marked by both technological innovation and expanding end-use cases, solidifying compound semiconductor photonics as a critical enabler of the digital economy.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global compound semiconductor photonics market is witnessing robust growth, with regional dynamics shaped by technological advancements, end-user demand, and government initiatives. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct opportunities and challenges for market participants.

- North America: North America remains a leading region, driven by strong investments in 5G infrastructure, data centers, and advanced defense systems. The United States, in particular, benefits from the presence of major players and research institutions, fostering innovation in photonic integrated circuits and high-speed optical communication. The region’s focus on next-generation wireless and quantum technologies further accelerates adoption. According to SEMI, North America’s compound semiconductor photonics market is expected to maintain steady growth, supported by robust funding and a mature ecosystem.

- Europe: Europe’s market is characterized by significant R&D investments and a strong emphasis on sustainability and energy efficiency. The European Union’s initiatives, such as the Horizon Europe program, are catalyzing advancements in photonic devices for automotive LiDAR, industrial automation, and healthcare diagnostics. Germany, the UK, and France are at the forefront, leveraging collaborations between academia and industry. Photonics21 highlights Europe’s leadership in silicon photonics and compound semiconductor integration, positioning the region as a key innovator in the global market.

- Asia-Pacific: Asia-Pacific is the fastest-growing region, propelled by large-scale manufacturing, rapid urbanization, and surging demand for consumer electronics and telecommunications. China, Japan, South Korea, and Taiwan are major contributors, with government-backed initiatives to localize semiconductor supply chains and boost photonics R&D. The proliferation of 5G networks and the expansion of data centers are major growth drivers. SEMI reports that Asia-Pacific’s dominance in wafer fabrication and optoelectronic device production underpins its market leadership.

- Rest of World (RoW): The RoW segment, including Latin America, the Middle East, and Africa, is experiencing gradual growth. Market expansion is primarily driven by increasing investments in telecommunications infrastructure and the adoption of smart city technologies. While the region lags in manufacturing capabilities, partnerships with global technology providers are enabling access to advanced photonic solutions. According to IDC, the RoW market is expected to see incremental gains as digital transformation initiatives gather pace.

In summary, while North America and Europe lead in innovation and R&D, Asia-Pacific dominates in manufacturing and market scale, and the RoW is emerging as a promising frontier for compound semiconductor photonics in 2025.

Future Outlook: Emerging Applications and Investment Opportunities

The future outlook for compound semiconductor photonics in 2025 is marked by rapid technological advancements and expanding investment opportunities, driven by the surging demand for high-speed data transmission, advanced sensing, and next-generation display technologies. Compound semiconductors, such as gallium arsenide (GaAs), indium phosphide (InP), and gallium nitride (GaN), are increasingly favored for their superior optoelectronic properties compared to traditional silicon, enabling breakthroughs in photonic devices.

Emerging applications are particularly prominent in the fields of 5G/6G telecommunications, data center interconnects, and quantum photonics. The proliferation of cloud computing and AI workloads is accelerating the adoption of high-speed optical transceivers based on compound semiconductors, which offer higher bandwidth and energy efficiency. According to Yole Group, the compound semiconductor photonics market is expected to see double-digit growth rates through 2025, with optical communication components representing a significant share of new deployments.

In automotive and industrial sectors, LiDAR systems leveraging compound semiconductor lasers are gaining traction for advanced driver-assistance systems (ADAS) and autonomous vehicles. The superior wavelength control and power efficiency of these materials are critical for reliable, high-resolution sensing. Additionally, the miniaturization of photonic integrated circuits (PICs) using InP and GaAs is opening new avenues in medical diagnostics, environmental monitoring, and consumer electronics, as highlighted by IDTechEx.

Investment opportunities are expanding across the value chain, from material suppliers and epitaxy equipment manufacturers to device designers and system integrators. Venture capital and corporate investments are increasingly targeting startups focused on photonic chips for AI accelerators, quantum computing, and next-generation displays, such as microLEDs. Strategic partnerships and M&A activity are also intensifying, as established players seek to secure intellectual property and scale production capabilities. For instance, ams OSRAM and Coherent Corp. have both announced significant investments in compound semiconductor fabs and R&D.

Looking ahead to 2025, the convergence of compound semiconductor photonics with AI, quantum technologies, and advanced manufacturing is expected to unlock new markets and drive robust growth. Stakeholders who position themselves early in these emerging applications stand to benefit from the accelerating shift toward photonic-enabled solutions across multiple industries.

Challenges, Risks, and Strategic Opportunities

The compound semiconductor photonics sector in 2025 faces a complex landscape of challenges, risks, and strategic opportunities as it underpins critical advancements in telecommunications, data centers, automotive LiDAR, and emerging quantum technologies. The market’s growth is propelled by the superior optoelectronic properties of compound semiconductors such as gallium arsenide (GaAs), indium phosphide (InP), and gallium nitride (GaN), but several hurdles must be addressed to fully realize their potential.

- Manufacturing Complexity and Cost: Compound semiconductor photonic devices require sophisticated epitaxial growth and fabrication processes, which are more intricate and costly than those for silicon-based devices. Yield issues, wafer size limitations, and the need for specialized equipment contribute to higher production costs, posing a barrier to large-scale adoption and price-sensitive applications. Companies like ams OSRAM and Coherent Corp. are investing in process optimization and automation to address these challenges.

- Supply Chain Vulnerabilities: The supply of high-purity raw materials (e.g., indium, gallium) is subject to geopolitical risks and market volatility. Disruptions can impact device availability and pricing, as highlighted by recent fluctuations in rare material markets (U.S. Geological Survey). Strategic sourcing and recycling initiatives are becoming increasingly important.

- Integration with Silicon Photonics: The integration of compound semiconductors with silicon photonics platforms is a key opportunity, enabling high-performance, cost-effective photonic integrated circuits (PICs). However, challenges remain in terms of lattice mismatch, thermal expansion differences, and process compatibility. Collaborative R&D efforts, such as those led by imec and CSEM, are advancing hybrid integration techniques.

- Market Diversification and Application Expansion: While telecom and datacom remain dominant, strategic opportunities exist in automotive sensing, medical diagnostics, and quantum photonics. Companies are leveraging compound semiconductors’ unique properties to develop differentiated products for these high-growth sectors (Yole Group).

- Intellectual Property and Talent Shortages: The field is highly competitive, with significant patent activity and a shortage of skilled engineers and researchers. Firms are investing in talent development and IP strategies to secure long-term competitive advantages.

In summary, while the compound semiconductor photonics market in 2025 is poised for robust growth, success will depend on overcoming manufacturing and supply chain risks, advancing integration technologies, and capitalizing on new application domains.

Sources & References

- MarketsandMarkets

- Lumentum Holdings Inc.

- ams OSRAM

- imec

- Oxford Instruments

- Hamamatsu Photonics

- TRIOPTICS

- Rockley Photonics

- Photonics21

- IDC

- IDTechEx

- CSEM